TSO CONSIDERS NEW ANTI-WAGE THEFT ORDINANCES

Photo: flckr.com

Amherst Town Council is considering three new anti-wage theft ordinances. The ordinances are meant to address a growing crisis in America where millions of workers are not being paid according to wage and hour laws. Wage theft can take many forms, including when workers are:

- Paid less than minimum wage;

- Not paid time and a half for overtime hours;

- Forced to work off the clock or having illegal fees deducted from paychecks;

- Paid cash wages;

- Not provided worker’s compensation to protect them from workplace injuries;

- Misclassified as independent contractors so that employers can avoid paying minimum wage, overtime, workman’s compensation, or payroll taxes.

Wage theft is especially pervasive in the construction and hospitality industries.

Drafts of the proposed Amherst ordinances can be found here, here, and here. Similar ordinances have already been passed in Western Massachusetts in Northampton, Easthampton, and Springfield. The cities of Boston, Cambridge, Chelsea, Lynn, Medford, New Bedford, and Worcester have also implemented wage theft protections.

The proposed ordinances are sponsored by Councilors Pat DeAngelis (District 2), Mandi Jo Hanneke (at large), and Cathy Schoen (District 1) in collaboration with the Pioneer Valley Workers Center (PVWC). The draft proposals were introduced at the second meeting of the Town’s new Town Services and Outreach Committee (TSO) on Tuesday, April 22. TSO heard reports from the sponsors of the legislation and from Rose Bookbinder, Margaret Sawyer, and Lisa Clauson representing the PVWC. PVWC is promoting such legislation in Amherst and other towns. A copy of their PowerPoint presentation can be found here.

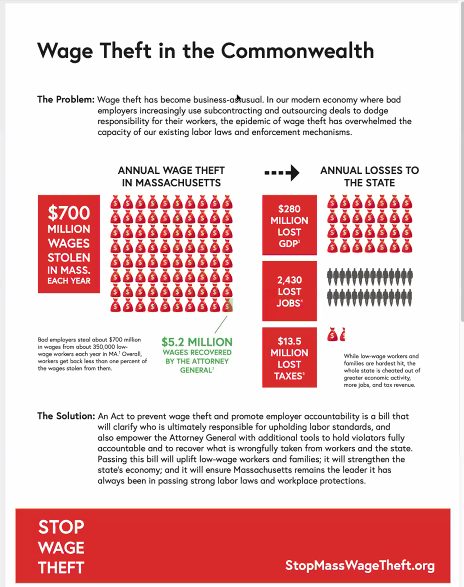

The presenters emphasized that wage theft hurts everyone. They pointed out that more than $700 million in wages is stolen in the Commonwealth each year and that it results in $280 million in lost Gross Domestic Product (GDP), 2,430 lost jobs, and $13.5 million in lost taxes. (see below)

What Do The Proposed Bylaws Do?

One goal of the proposed bylaws is to ensure the Town of Amherst is not using public funds, through contracts or tax relief, nor granting simple business licenses to companies with a history of wage theft abuse. Companies and contractors that “play by the rules” and pay employees properly, pay taxes, pay workers comp should not have to compete against companies that have been known to violate wage and hour rules. Companies that steal from workers by not paying them in full are often committing taxpayer fraud, too, by paying lower payroll taxes. The bylaws further protect workers across industries by linking access to a Town business license with a business’s wage and hour claims history.

How Do the Bylaws Prevent Wage Theft?

The proposed ordinances protect against wage theft through changes in business licensing and construction contracts.

Business Licenses

According to the proposed bylaws, if an employee claims wage theft from an area business, a Wage Theft Committee would investigate. A business could be fined and could be required to take out a wage bond to cover employees’ wages in the future as a condition to receive or renew a Town business license. This measure has been used effectively in other cities and towns as a deterrent to wage theft.

Construction Contracts

Contractors and developers who receive public funds would need to ensure that all of their contractors and sub-contractors that perform construction work on a publicly supported project:

- Follow existing wage and hour laws, properly classify employees, provide worker’s comp insurance, follow health care laws, and pay their taxes;

- Confirm they have not had a wage theft/tax fraud/insurance fraud violation over the past five years;

- Prioritize hiring Amherst residents;

- Create opportunities for women and people of color in the construction work. (This requirement is in keeping with Massachusetts state construction goals set up to address findings of disparities in the construction industry. These projects will be required to have people of color perform minimally 15.3 percent work hours and women perform minimally 6.9 percent work hours.)

- In support of and recognition of veterans and their contributions, projects will also be required to have veterans perform minimally 5 percent of work hours.

In addition, if wage theft happens on a publicly supported project, there will be financial ramifications for the developer and contractor or sub-contractor.

As a result of these requirements, developers will pass on the financial ramifications in their contracts with their construction managers or general contractors and those construction managers or general contractors will pass on the financial ramifications in their contracts with their subcontractors. Contractual ramifications for wage theft have been found to successfully deter contractors from engaging in it.

Why Are These Protections Even More Needed During the COVID-19 Pandemic?

The COVID-19 pandemic is exposing dangers that many low-wage jobs pose for workers, and the fragile economic positions they are often in. As less work is available, and an increasing number of workers grow more desperate for paychecks, they are less likely to speak up about their rights and injustices on the job. It becomes even more important to shine a light on the problem of wage theft and to work to deter it from happening.

If Wage Theft Is Policed by the Attorney General’s Office, So Why is Municipal Action Necessary?

The Attorney General’s office doesn’t have enough investigators to adequately stop the problem. Cynthia Mark, Chief of the Attorney General’s Fair Labor Division, which consists of 13 lawyers and 20 investigators, testified on March 27, 2018 in favor of local ordinances addressing wage theft issues.

Unique Features

Councilor DeAngelis noted that the ordinances require inclusion of workers who are typically excluded from the construction trades, notably women and people of color. The ordinances also have clawback language to recover money from those who have not adhered to the law. And they add a wage and tip bylaw that Amherst’s current bylaws lack.

Enforcement

The bylaws would create a wage theft advisory committee that would have seven members, including the Town Manager or designee, a representative from the Human Rights Commission, a representative from the Chamber of Commerce, a representative from the PVWC, and a trade union representative.

Discussion

Councilors Evan Ross (District 4) and Alisa Brewer (at large) raised concerns about whether having worker complaints aired in a public body was contrary to Town practices. Brewer stated that “we can’t allow people to come before a town body and file a specific complaint about violation of their rights.” Bookbinder reiterated that the ordinance does require a public process, and added that the experiences of other communities indicate that people who are being victimized by wage theft are willing to come forward. They have the option of filing a complaint with the Attorney General on their own or hiring a private lawyer, but the bylaw gives them an option to address their complaint locally, which has proven to be the most effective and expeditious way to prevent or redress wage theft. Clauson added that although wage theft is pervasive in the construction and hospitality industries, it rarely seems to happen when it is addressed in construction contracts. Ross said he would like to hear more about the Chamber of Commerce’s perspective.

The proposal will be discussed again at TSO’s next meeting.

Additional information on wage theft and legislation can be found below.

Lisa Clauson’s Letter to the Daily Hampshire Gazette on Wage Theft

Easthampton City Council Passes Wage Theft Ordinance

Lynn City Council Passes Wage Theft Ordinance

Northampton Adopts “Fair Employment City” Status

Northampton Adopts Wage Protection Ordinance

Challenges and Opportunities for Workers in the Northampton Restaurant Industry

Gaming the System: A Report From Community Labor Unite