A Few Questions For Former Jones Library President Sarah McKee About Historic Rehabilitation Tax Credits

Jones Library stairway as it looks today. The original stairway was carved from Philippine walnut. Note the intricate hand carving on the newel post. Photo: From a slide presentation by Eric Gradoia

The fundraising goal of $17 million for the Jones Library project is a considerably bigger lift than the library’s earlier goal of $6 million, and includes selling historic rehabilitation tax credits, which is trotted out by the library’s current trustees and marketing people at every opportunity as if it is a sure thing . But what is it? How much of a sure thing is it? How much money would it mean for the construction project?

Here, former Jones Library Trustee president, history buff, and Washington, D.C. Bar member Sarah McKee explains basics of historic rehabilitation (sometimes called preservation) tax credits.

Please note that after initial publication of “A Few Questions for Sarah McKee”, we were informed by McKee that Town of Amherst Finance Director Sean Mangano told her today (9/23), via a voice message, that the town has not yet applied for Historical Rehabilitation Tax Credits for the library.

Indy: Who provides historic rehabilitation tax credits? I just got shut down by the agency I thought is responsible for them, the Massachusetts Historical Commission [MHC], whose representative was so bold as to say, after indicating that they don’t talk [on the telephone] to the public, “We don’t talk [on the telephone] to the media.”

You’re right, the Massachusetts Historical Commission is the state agency that administers historic rehabilitation tax credits. Such tax credits are a powerful incentive to restore, adapt, and preserve our irreplaceable built history rather than demolishing it and constructing something completely new. UMass Professor of Architecture Max Page discusses their importance for both history and the environment in his invaluable Why Preservation Matters [Yale University Press, 2017].

The legislature determines the total of such credits to allow. The present Massachusetts Historic Rehabilitation Tax Credit Program will expire on December 31, 2027.

And no, the MHC does not like to do business with the public over the phone. But it reports to the Secretary of the Commonwealth, William Galvin. So that’s where to take concerns if you need to.

What are these tax credits for? How are they used?

Historic rehabilitation tax credits allow a qualified owner of a historic commercial building to save money on its taxes, in exchange for preserving or restoring the historic structure in whole or in part. Besides state programs, there’s a federal program for historic preservation tax credits.

But the Jones Library is a non-profit corporation, so it can’t use any historic rehabilitation tax credits it might be awarded. There is, however, a market in such unusable tax credits. A for-profit entity with an appropriate tax liability could pay the Jones for its tax credits and then use these to reduce its own tax.

That’s what the trustees intend to do: sell their unusable tax credits. It’s an imaginative way to encourage non-profits, as well as commercial building owners, to preserve their built history rather than to demolish it.

“If the trustees and town don’t provide [the required historic preservation information], they’ll frustrate the [state] historic commission’s legal process to eliminate, minimize, and mitigate ‘adverse effects’ on the historic 1928 library building…. They’ll also be in breach of their grant contract with the MBLC.”

Sarah McKee, Former Jones Library Trustees President

But has the library formally applied for historic rehabilitation tax credits and submitted all the necessary documents?

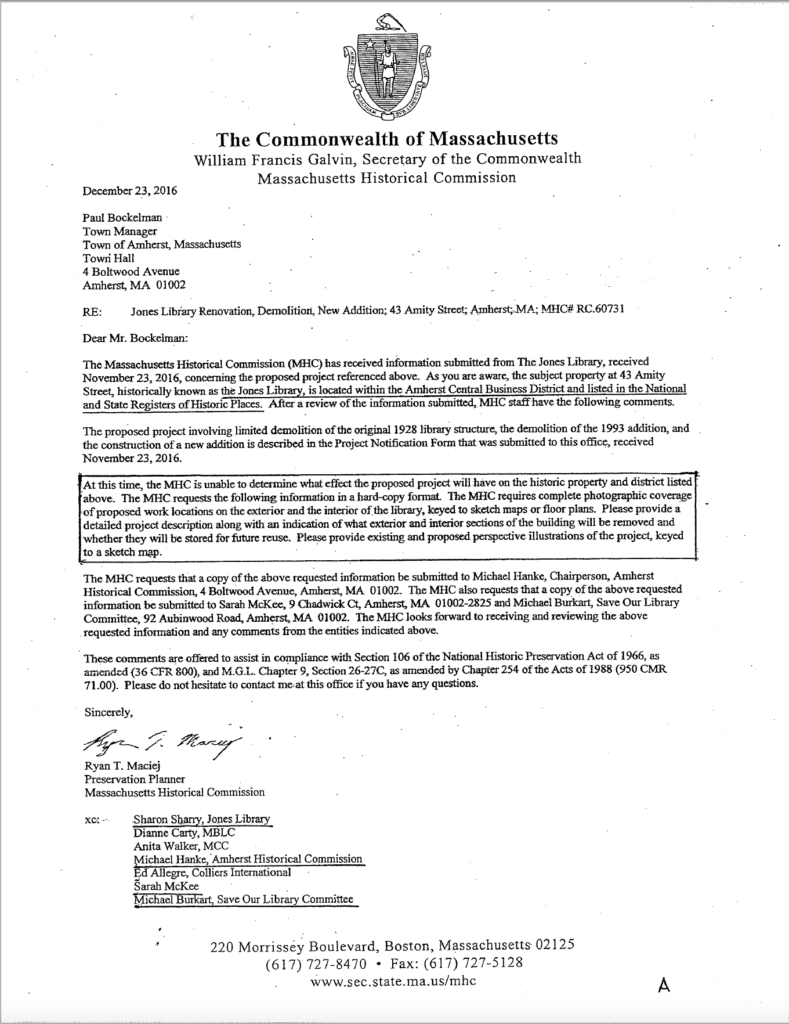

The library/town must have provided some documents in November of 2016 because I was cc’d on a response from the MHC to the town manager on December 23, 2016 (see below). The MHC said that they require more data before they can make a determination about the effect that the proposed Jones Library project would have on the historic property and district. I know that the library/town hasn’t submitted any of the detailed historic “destruction” documentation they were asked to provide in that letter and under Massachusetts Historic Preservation Law, and as mandated in their grant contract with the Massachusetts Board of Library Commissioners (MBLC). In the same letter, the MHC told Town Manager Paul Bockelman that it “…requires complete photographic coverage of proposed work locations on the exterior and interior of the library, keyed to sketch maps or floor plans…. a detailed project description along with an indication of what exterior and interior sections of the building will be removed and whether they will be stored for reuse…. existing and proposed perspective illustrations of the project, keyed to a sketch map.” The library director, the Amherst Historical Commission, and others were also cc’d.

If the library/town don’t provide this information, they’ll frustrate the historical commission’s legal process to eliminate, minimize, and mitigate adverse effects on the historic 1928 building. More changes will almost certainly have to be made to the schematic design. They’ll also be in breach of their grant contract with the MBLC, and the town will be required by law to give back the $2.7 million in grant money it’s already received, plus interest. And it wouldn’t get any more.

Who is the best resource for information about the status of an application the town/library might have made? Maybe an application has been made and a decision has been made, and our finance people can roughly estimate how much money the tax credits are reasonably likely to raise….

Town Manager Bockelman should know all that. Sometimes the best way to obtain copies of town or library documents is to file a state Public Record Request for them with the town manager for the town and with the library director, Sharon Sharry, for the library. Emailed requests are fine. Public officials have 10 business days to provide the requested documents, if they exist of course. Filing a Public Record Request directly with the MHC is also possible.

I do want to mention that the MHC’s website lists projects that have received awards of historic rehabilitation tax credits through April 29, 2022 and doesn’t mention the Jones Library. [See recent MHC awards] More recent information would have to come directly from the MHC or the town.

The library seems to be counting on historic tax credits as a sure thing. Let’s assume we get them. What’s the process of selling them? Would the town have to sell to the highest bidders or could they vet them and take into account their policies and practices on ethical issues, such as social justice and sustainability?

Great questions! Town officials and the library trustees are likely to be your best bet for answers.

Thank you. You’ve enlightened us plenty! Now to file those public record requests….