FY23 Budget Process Begins

Photo: Picpedia.com. (CC BY-SA 3.0)

Combined Report On The Meeting Of The Amherst Town Council On October 3, 2022 And The Finance Committee On October 4, 2022

The council meeting was held in person and over Zoom and was recorded. The recording can be viewed here.

The Finance Committee meeting was held over Zoom and was recorded. It can be viewed here.

Present at Town Council Meeting

In the Town Room: President Lynn Griesemer (District 2), Andy Steinberg and Mandi Jo Hanneke (at large), Jennifer Taub (District 3), Pam Rooney (District 4), and Ana Devlin Gauthier (District 5)

Staff: Paul Bockelman (Town Manager) and Athena O’Keeffe (Clerk of the Council)

Participating remotely: Michele Miller and Cathy Schoen (District 1), Pat DeAngelis (District 2), Dorothy Pam (District 3), Anika Lopes (District 4), Shalini Bahl-Milne (District 5), and Ellisha Walker (at large)

Although the public was permitted to attend in person, no one did. There were 18 people present on Zoom.

Present At Finance Committee Meeting

Andy Steinberg (Chair), Cathy Schoen, Lynn Griesemer, Michele Miller, and Ellisha Walker.

Non-voting members: Bernie Kubiak, Matt Holloway, Bob Hegner

Staff: Paul Bockelman (Town Manager) and Sean Mangano (Finance Director)

Residents’ requests for capital projects are due this month.

Budget Process For FY2023

Finance Director Sean Mangano outlined the budget process, which consists of four phases.

1.requests from residents for capital projects due this month, as well as financial indicators and other engagement- and direction-setting,,

2. budget development and a preliminary capital improvement program from January through April

3. review of budget proposal to the Town Council, May 1, with a public hearing in June, and

4. budget implementation phase

Mangano stressed that revenues are limited by Proposition 2½, which limits the total increase in property tax revenue to a 2½ % increase over the previous year exclusive of new growth. He said Amherst has benefitted from the fact that there has been new construction over the past five or ten years, allowing for an increase in property tax revenue.

The public may give input into the budgeting process by contacting the town council, school committee, library trustees, or town manager; the Engage Amherst website https://engageamherst.org/ ; attending the public forum in the fall or the public hearing in June; and commenting at the public meetings of the Finance Committee, Joint Capital Planning Committee, and town council. Michele Miller (District 1) noted that when the African Heritage Reparations Assembly (AHRA) went door-to-door in apartment complexes in town, they encountered many residents who were unaware of what was happening in town government. She suggested that the town partner with apartment management companies and local agencies to increase communication with residents.

Costs Have Increased For The Four Major Building Projects

Due to an increase in construction costs and interest rates over the past year, cost estimates for the new elementary school, Jones Library expansion, South Amherst fire station, and Department of Public Works (DPW) buildings have greatly increased. The town must recalibrate its plans for the projects, taking a fresh look at different options for completing the projects while balancing budgetary flexibility, liquidity, and an affordable debt service. A revised model for the building projects will be discussed in detail at the October 18 Finance Committee meeting.

Mangano summarized the current state of the four projects. The elementary school is estimated to cost $100 million, with state reimbursement covering 30 to 40%. Because of a change in the deadline for submitting the final design to the Massachusetts School Building Association (MSBA), the town will not have updated cost estimates until after the April 1, 2023 MSBA meeting. Therefore, he anticipates a May 2 vote on the debt exclusion override for the project.

Mandi Jo Hanneke (at large) said she was “flabbergasted” that a date for the override vote had been set without any discussion with the council. Elementary School Building Committee Chair Cathy Schoen (District 1) explained how changes in the MSBA deadlines had led to the May date for the vote, and that on May 2, the schools, colleges and UMass are still in class, which means that most residents would be in town. Schoen added that if the Fair Share amendment passes in November there will be more state revenue for public education available.

Mangano said that the estimated cost for the Jones Library project has increased $10 to $15 million over the original figures. The library trustees are still working on budget reductions and design changes to bring costs down. The final figures will come before the council between October, 2023 and January, 2024. The town is still searching for a site for the DPW, and plans to build the fire station at the current DPW site.

Although Hanneke urged the town to move ahead with the new fire station without waiting to find a DPW site, Town Manager Paul Bockelman said the DPW building is in worse shape than the central fire station. He said potential DPW sites will be discussed in executive session at the October 17 council meeting. Pat DeAngelis (District 2) suggested that Hickory Ridge might be an excellent site for a fire station.

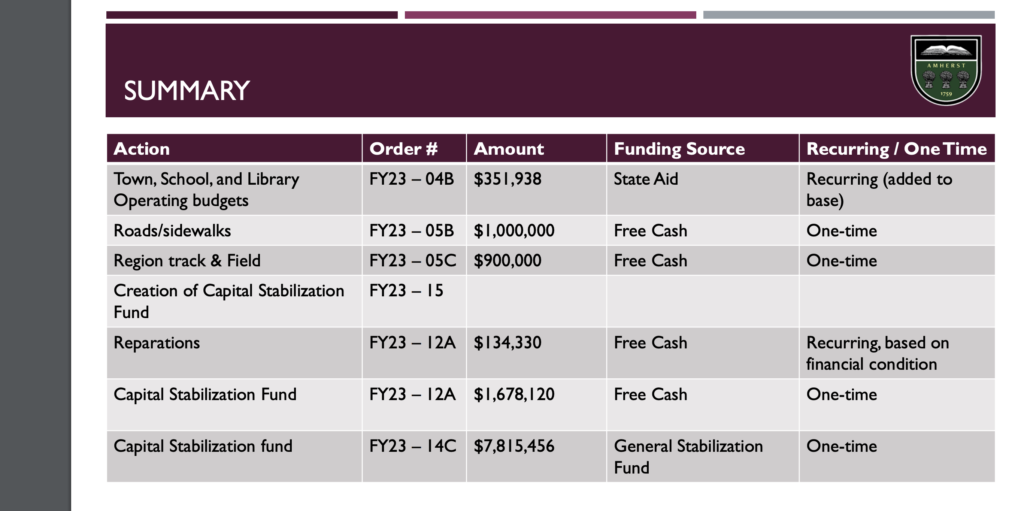

Supplemental Appropriations Proposed

Because of a surplus in free cash in FY 2022 and an increase in state aid, the Finance Department has proposed allocation of these funds to various sources .

The town aims to keep free cash at 5% of the total operating costs and the stabilization fund (to guard against economic downturns and maintain a favorable bond rating) at 15%. Amounts above these values can be allocated to areas in need.

Mangano proposed an increase of 0.5%, or $352,000, to the operating budget of the town to help cover four additional firefighters, the elementary school arts programs, and mental health initiatives at the regional schools, which are now supported by time-limited grants. He also proposed using free cash to give $900,000 toward the regional school track and field project to fulfill Amherst’s obligation for the project, $1 million toward road and sidewalk repair, and $134,000 for the reparations stabilization fund (an amount equal to FY22 cannabis tax revenue).

In addition, he advocated creating a capital stabilization fund using $7.8 million from the general stabilization fund and $1.6 million in free cash. The capital stabilization fund would provide reserves for the four major capital projects. The Finance Committee unanimously endorsed all of these supplemental appropriations at the October 4 meeting. Creation of the capital stabilization fund will require a 2/3 vote of the council.

A public forum on the financial orders for supplemental funding in the table above will be held at 6:30 p.m. on October 17 before the regular council meeting.