Town Plans Historically Large Tax Hike For New School. Tapping Reserves May Reduce It

Average Home Would See $478 Added To Regular Tax Bill Through Mid-century

Town Manager Paul Bockelman and Finance Director Sean Mangano introduced a plan to finance the Fort River Elementary School Building Project in a presentation before the Town Council on Monday night. Their recommendation is to fund the town’s share of $55.5 million for the school project by borrowing the money and repaying the debt through a property tax increase to be in effect for 30 years.

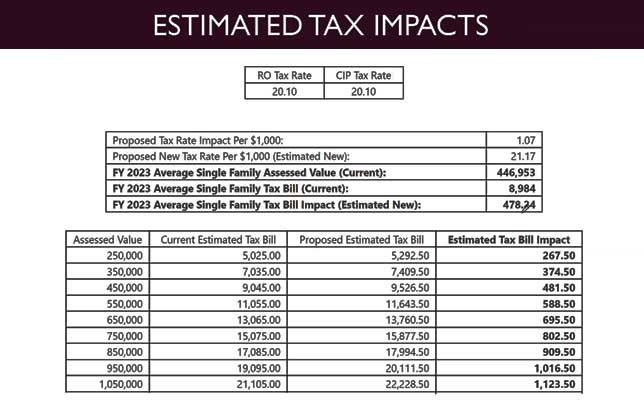

Mangano put the magnitude of the tax increase into the context of current FY23 economic data. Today’s average Amherst single family home with an assessed value of $446,953 would see its annual tax bill of $8984 jump to $9462, an increase of $478. The impact on the town’s current property tax rate of $20.10 per $1000, presently the fifth highest rate in Massachusetts, would be an increase of $1.07 to $21.17 per $1000.

The town proposes to increase taxes beyond the 2.5% annual increase imposed by Proposition 2½ though a mechanism know as a debt exclusion. The debt exclusion must be approved by a majority of voters in a town wide referendum on May 2 which is before college and university students have left for the summer. Town officials have warned not to call it an “override” because a debt exclusion, unlike a technical override, does not raise the base amount that 2.5% levy limits are measured from, and the tax increases are temporary. However, concerned citizens should be aware that debt exclusion tax increases are above and beyond Proposition 2½ limits and “temporary” in this case, means starting in 2025 and continuing through 2056.

The average $478 debt exclusion tax will be stacked onto property owners’ regular annual tax hikes which result from allowable 2½% increases, appreciating home values, new growth in town and past overrides and debt exclusions. Over the past 30 years Amherst property owners have seen their tax bills grow by 5.05% each year on average. Recent average tax increases have been $200 in 2021, $419 in 2022 and $375 in 2023.

Only once in Amherst’s history has a tax increase exceeded $475 — $553 in 2005, after Amherst voters approved a $2 million override and property owners were taxed roughly $500,000 for two school project debt exclusions.

Recognizing the importance of a new elementary school to many Amherst residents, several town councilors have proposed measures that would reduce the financial strain on Amherst residents by lowering the amount needed to be raised by a debt exclusion.

[See related Assumptions About Major Building Projects Need To Be Revisited, Say Town Councilors]

District 1 councilor Michelle Miller spoke out at the February 6 Town Council meeting to say, “It’s important that the town show its commitment to the project but also that we try to reduce the burden to the taxpayer as much as possible … I know we have quite a reserve — I think it’s maybe $24 million — so I am wondering if there are any plans to explore allocating some of that money for this project?”

Mangano replied, “the goal of the council is to get four building projects completed and those reserves play a really critical role in some of the other projects.” The other three projects are a new fire station and Public Works headquarters, for which locations have not yet been identified, and a $46.1 million renovation-expansion of the Jones Library, the viability of which has remained in question since the project was found to be $14 million over budget, and which more than one-third of the voters opposed in a 2021 referendum, before the financial impacts of the building project were fully known.

[See related Town Prepares To Press Forward On Foundering Library Project]

The debt exclusion plan was presented to the Finance Committee on Tuesday afternoon, where member Bob Hegner echoed Miller’s concern for the taxpayer, as did Amherst resident Toni Cunningham, the lone speaker during the public comment period. However, the most forceful criticism of the large tax increase and defense of Amherst’s vulnerable, limited-income residents came from Town Councilor At-Large Ellisha Walker.

“I think there’s a serious disconnect from people who live in poverty in this town, and I can sense it very strongly in this meeting right now,” she said. “It’s very much bothering me because of my family’s financial standing that there are people who will not be able to continue to live in this town once this payment hits, and there are people whose kids will not be able to go to this school because this payment is going to hit, and we need to be thinking about them on the front end not on the back end as a last resort.”

Both Hegner and Walker expressed concern over the impact of the tax increase on renters. “As a renter myself I can understand that as fees or costs increase to my landlord, that increase gets passed on to me. That happened literally to me last month,” said Walker.

“I frankly couldn’t afford Amherst if I had to move in today,” commented Finance Committee member Bernie Kubiak.

The third non-voting town representative to the Finance Committee (along with Hegner and Kubiak), Matt Holloway, disclosed at the start of the meeting that he has taken on the role of co-chair of the ballot initiative committee called “Vote ‘Yes’ For Amherst Schools.” He reported consulting both the state ethics and campaign finance boards and was counseled to file a Disclosure of Appearance of Conflict of Interest and to disclose his involvement with the Vote ‘Yes’ ballot initiative to the Finance Committee.

“The Ballot Initiative Committee has had to put firewalls in place to prevent any kind of interaction between myself and fundraising in any way,” he said. “I believe I can participate objectively and support the public interest of the town during [Finance Committee] discussion.”

The Finance Committee is expected to discuss options for reducing the size of the debt exclusion at their next meeting on February 21.

[See related Council And Finance Committee Move Forward On New Elementary School And Water Plant]

Wondering whether anyone’s organizing to DEFEAT the upcoming school tax override?

How about we withdraw from the over-sized, over-priced scheme for the PRIVATELY owned Jones Library, and fund the new PUBLIC school first?

James Murphy

Mr. Murphy:

Our town elders made the political decision a few years ago that a new school was deemed to be such a popular project that it was safest to finance the garage, fire station and library debt from tax revenue, as an override or debt exclusion was less likely to be approved for them.

To tenants:

Are you aware that these tax increases will be on top of the increased permit and inspection fees proposed in the Rent Registration bylaw now in development. Along with Sanitary and Building code compliance, compliance with sustainability standards is being proposed. Making older buildings comply with 21st century regulations is very expensive and all these costs are sure to be passed on as higher and higher rent levels.

The market value of my home is dependent upon the quality of the Amherst schools. No one buys a house and raises a family in a high property tax town unless its schools are perceived to be better than those in neighboring lower-taxed towns. As a priority, Town funds should go to education FIRST. All other big spending projects are secondary to education. If there is not enough $ to finance everything, let your Councilor know your priorities before your property taxes are increased again.

Rob Robertson – no one is organizing against the Debt Exclusion Override that I know of.

Most if not all of the reasons many people opposed the previous school project are addressed in this iteration, such as a lower enrollment, longer grade span, innovative curriculum, no fossil fuels, lots of green space, etc. As I wrote in a letter to the Gazette this week, there is much to love in this school project. The cost is the hard pill to swallow and that is why I agree with Jeff Lee that the town should be dedicating at least $10 million of the ~$25 million of rainy day funds (“reserves”) to reduce the amount that will have to be borrowed and subject to a Debt Exclusion Override for the school project. Those reserves are our property taxes, saved up for exactly this kind of purpose.

Sadly, some councilors have repeatedly demonstrated a lack of interest in the concerns or opinions of their constituents. How many district meetings has your councilor sponsored?

And what about the constraints imposed on “public comments” periods? While we are constantly reminded of how much TC members have on their plates, some continue to introduce new initiatives (time and money) when many residents I know have expressed their preference for first fixing what’s broken (e.g., sidewalks instead of streetlights).

James Murphy

what kind of school system will we have with a $100 million, net zero, bragging rights building, filled with underpaid, dis respected

teachers and paras. amherst get our our priorities corrected, now.

Toni, I agree that there is much to commend in the new school plan and I’m grateful for your persistent efforts to reduce the project’s cost. I am, however, seriously troubled by the prospect of passing a roughly $500 per year average debt exclusion tax increase on top of Amherst’s regularly high annual tax increases. I believe that Amherst government’s disregard for less affluent taxpayers threatens to further damage the town’s demographic and socioeconomic diversity.

In addition to using reserves, I would urge town leaders to change course by funding the school project — arguably townspeople’s top priority building expense — out of existing tax revenues and let the library, and if necessary other capital expenditures, depend on a debt exclusion. Then we Amherst voters can decide for ourselves if the expense of, say, a larger library is worth increasing our housing costs for.