Opinion: Amherst Taxation Trends Portend A Dystopian Future

Most Amherst residents are well aware that our property tax bills are significantly higher than in neighboring towns. With town leaders debating how best to pay for an arguably much-needed elementary school, it is instructive to look at how a proposed property tax increase will affect taxpayers and residents over the coming decades.

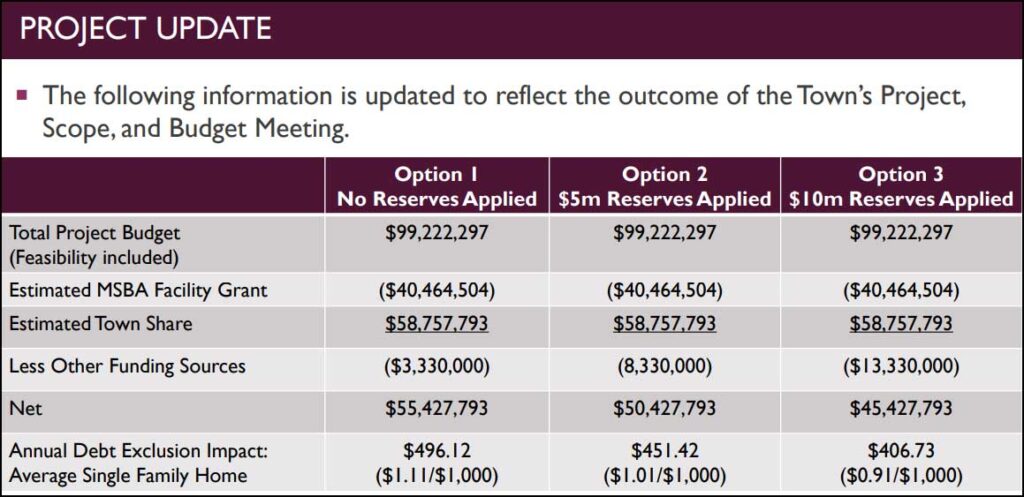

Finance Director Sean Mangano has announced that the school project will cost $99.2 million, with the town share after a state grant and other funding sources projected to be $55.4 million. The Amherst Finance Committee has recommended that that town borrow the necessary funds and ask town voters to pass a “debt exclusion” Proposition 2 ½ override that will increase property taxes by an amount necessary to service the debt.

The Town Council is considering using up to $10 million of existing reserves to lower the amount of borrowing required. The Finance Committee has recommended a $5 million amount which would result in the average Amherst single-family home being assessed a debt exclusion tax increase of $451.42 annually for the thirty-year term of the debt.

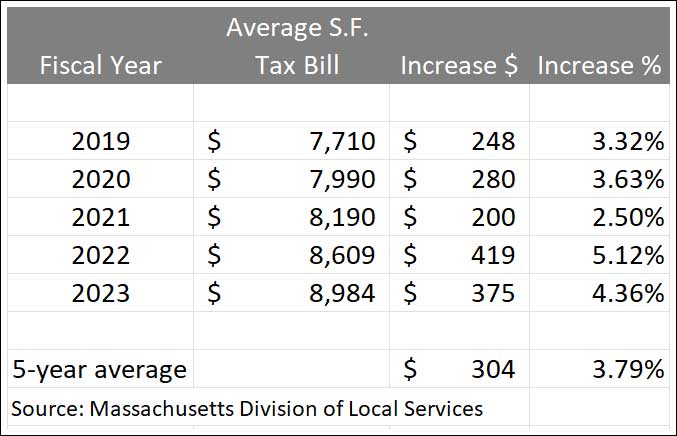

The yearly debt exclusion tax increases will be on top of the town’s regular annual tax increases subject to Proposition 2 ½ limits. Due to rising property values and past overrides, the year over year increase in the mean Amherst tax bill since 1993 has averaged 5.1%. For the purpose of projecting future tax bills, it makes more sense to use the average increase over the past five years which is a lower 3.79%.

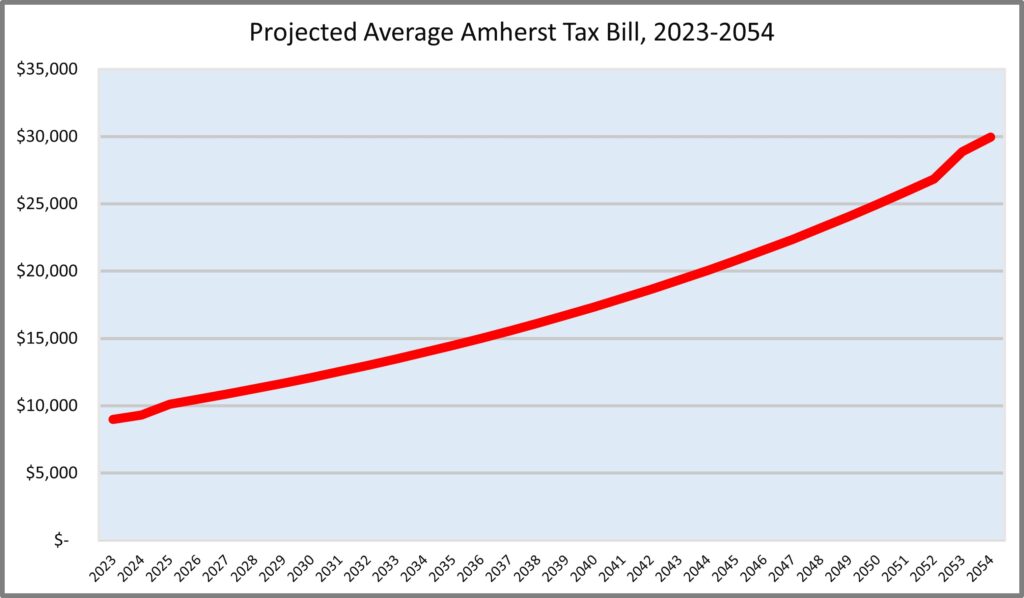

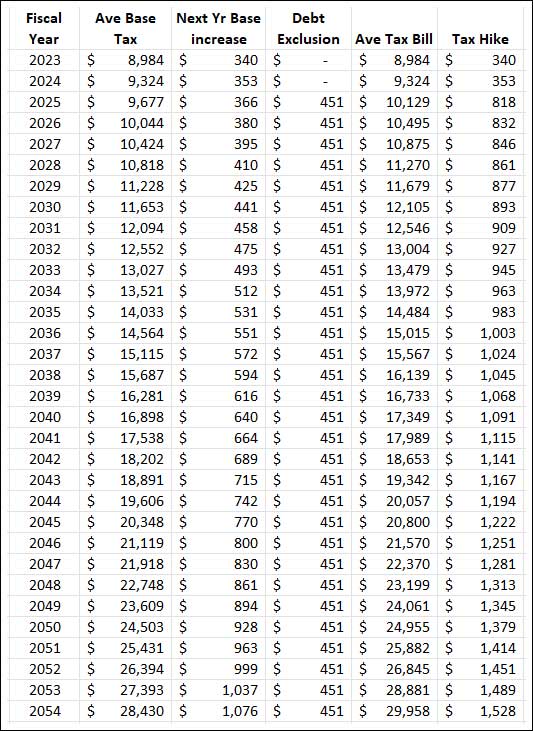

Applying a 3.79% yearly increase over the next 30 years to Amherst’s current average single family tax bill yields the chart below.

The chart reveals some eye-catching milestones.

- 2025 – The first year that the debt exclusion will factor into tax bills. The average annual bill exceeds $10,000.

- 2031 – The base (within Prop. 2 ½ limits) tax increase is now greater than the debt exclusion increase.

- 2036 – Average annual tax hike passes $1000. Average tax bill reaches $15,000.

- 2044 – Average tax bill passes $20,000.

- 2051 – Average tax bill passes $25,000.

- 2054 – Average tax bill is nearly $30,000. Fort River School debt is paid off.

It should be noted that even if yearly tax bills increase at the unprecedented low average rate of only 2.5%, the average tax bill will exceed $20,000 by 2054, the year that the school debt is paid off.

What does this scenario mean for Amherst residents and the makeup of the town?

Even if inflation remains high for several years and incomes rise accordingly, residents with fixed incomes will be hard pressed to meet their tax obligations or tax-induced rent increases. Amherst-based businesses will be forced to raise their prices and will become less competitive with similar businesses in Hadley, Northampton or online. They may leave town altogether.

Housing will grow less and less affordable for families looking to find starter homes in Amherst or to the low- and middle-income people who already live here.

The town’s affordable housing initiatives are unlikely to make a major impact on the problem. Many families of the students who attend the new Fort River Elementary School will likely be forced to find lower cost communities to live in. Amherst will increasingly become a haven for the upwardly mobile and financially secure and for university students.

It is a difficult systemic challenge that has been years in the making, but there are ways to slow runaway tax hikes. Citizens with concerns or ideas should attend the joint meeting of the Town Council and Finance Committee as they conduct a public forum on the amount of the debt exclusion override for the school that will be the subject of a town wide referendum on May 2. The public forum takes place at 6:00 p.m. on Monday, April 3.

Jeff, could you provide a dollar amount for the assessed value of an “average” single-family home in Amherst? That would help to give readers and residents an idea of how much more (or perhaps less) they might be paying in taxes if the full override amount is requested.

Good question, Denise. The average Amherst single-family home is currently valued at $446,953.