Failure to Preserve Library Historic Features Leads to $2M Fundraising Setback

Photo: https://www.joneslibrary.org/

No State Tax Credits for Building Project Says Director

At the July 9 Jones Library Building Committee (JLBC) meeting, Amherst Special Projects Coordinator Robert Peirent reviewed $32,500 in library project invoices that the Town is responsible for paying this month.

It was announced that to save money, Peirent has taken over for Tim Alix of Colliers as the interim Owner’s Project Manager (OPM) for the rebidding phase of the Jones renovation-expansion.

The invoice details two $16,250 charges: one listed as “Historical Commission” and the other as “MA Historic Commission Tax Credits.”

Peirent said that the expenses were related to follow-up meetings with the Amherst Historical Commission (AHC) and Massachusetts Historical Commission (MHC) and that the $32,500 represents the final invoice under the previous agreement for building project-related services. The Town has paid roughly $2.3 million under that agreement, with the funds drawn from a grant disbursement of $2.7 from the Massachusetts Board of Library Commissioners (MBLC) which may need to be returned if excessive cost or insufficient fundraising prevents the project from moving forward.

See related Jones Library Expansion Project on Hold. Town Manager and Public Respond to High Cost Estimate

Wondering if the MHC expenses had borne fruit, Town Council representative to the JLBC, Pam Rooney, asked “Do we have the tax credits in hand?”

Library Director Sharon Sharry announced, “No, we won’t be getting historic tax credits.”

“So this was money spent in an effort to obtain them, but you’ve decided to not pursue them?” asked Rooney.

“No, we pursued them, but we were denied,” admitted Sharry.

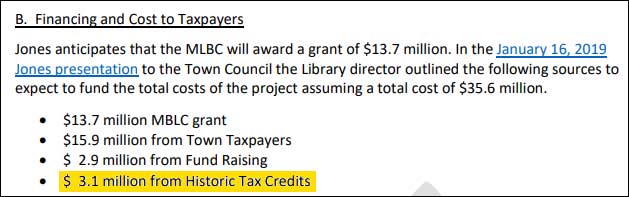

Massachusetts Historic Rehabilitation Tax Credits (MHRTC) have been a critical piece of the Jones Library Capital Campaign’s (JLCC) fundraising model to meet the Library’s share of the $46.1 million project cost. Estimates of the revenue represented by tax credits have ranged from $1.6 million to $4.2 million.

Town Manager Paul Bockelman’s Cash Flow memo to Town Council meant to convey Amherst’s funding capability before a vote to appropriate another $10 million to cover escalating project costs assumed $1.8 million to be received in historic tax credits.

Epsilon Associates of Maynard, MA was engaged to prepare and submit the MHRTC application to the Massachusetts Historical Commission.

According to public records obtained by the Amherst Indy, Epsilon first submitted a 299-page application for tax credits on May 1, 2023. Included were photos showing existing conditions of the building and describing planned changes.

The MHC responded on August 18 that the application was incomplete in not demonstrating that the library property meets the MHRTC requirement to be income-producing.

See related Indy Rewind: A Primer On Historic Rehabilitation Tax Credits For Income Producing Buildings

Epsilon submitted a second application on August 30 with supporting arguments added by Boston law firm Klein Hornig on October 12.

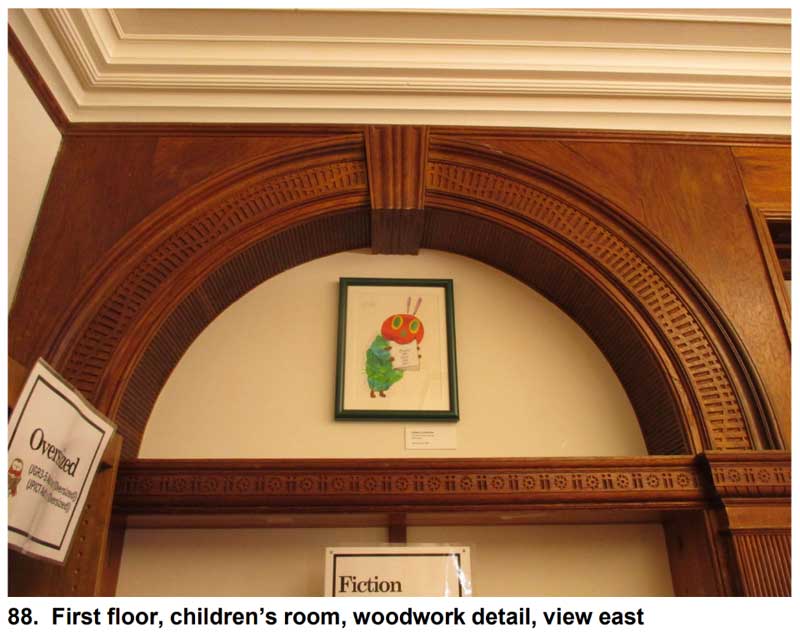

Brona Simon, Executive Director of the MHC and State Historic Preservation Officer (SHPO) responded on December 29, citing five examples of how the building project as then proposed would violate the Secretary of the Interior’s Standards for the Rehabilitation of Historic Properties. Among the standards that the SHPO found to be violated were

- “The historic character of a property will be retained and preserved. The removal of distinctive materials or alteration of features, spaces, and spatial relationships that characterize a property will be avoided.”

- “Distinctive materials, features, finishes, and construction techniques or examples of craftsmanship that. characterize a property will be preserved.”

- “New additions, exterior alterations, or related new construction will not destroy historic materials, features, and spatial relationships that characterize the property. The new work will be differentiated from the old and will be compatible with the historic materials, features, size, scale and proportion, and massing to protect the integrity of the property and its environment.”

The letter further stated that

“The Buckingham slate on the highly visible gambrel roof is proposed.to be replaced with a synthetic slate, even though the historic structures report states that Buckingham slate is still quarried and available as a roofing material. The removal of historic slate roof, which is highly visible and a character-defining feature of the building, and replacement with a synthetic slate does not meet the Standards (Standards 2 and 6).”

Epsilon tried again in early 2024, submitting a 240-page amended application in February. Over the preceding months the Jones Library Capital Campaign had ramped up the advocacy by securing letters of support from Town Council President Lynn Griesemer, State Representative Mindy Domb, State Senator Jo Comerford and U.S. Representative Jim McGovern. McGovern’s support was balanced, asking only that the MHC give Amherst “full and fair consideration” of the MHRTC request.

The MHC observed that the applicants had attempted to justify previously cited violations by claiming that they were supported by the Massachusetts Board of Library Commissioners (MBLC) and the Amherst Historic Commission.

Unmoved by political pressure, however, the SHPO reported in April that the MHC is bound by the MHRTC program regulations (830 CMR 63.38R.1) which mandate that the project be consistent with the U.S. Secretary of the Interior Standards which are aimed at protecting the public’s interest in maintaining the heritage and cultural value of Historic Places. The Jones Library is listed on the State and National Registers of Historic Places. Tax credits were once again denied.

JLBC Abandons Historic Preservation Goals

After the applications for historic tax credits were denied and the lone construction bid received in May was rejected for being $6.5 million higher than expected, the Jones Library Trustees, Director and JLBC dropped all pretense of seeking to maintain the historic value of the building.

On June 4 the JLBC voted unanimously to pursue cost-cutting “value engineering” design changes in preparation for bidding the project out again in September. The changes included replacing slate with asphalt shingles, eliminating interior millwork except for the lobby stairway, and going with cheaper window improvements. The Jones Library Trustees approved paying $550,700 from the library endowment to Finegold Alexander Architects (FAA) for redesign services.

See related Building Committee Approves Deep Cuts to Library Design

There were signs at the July 9 JLBC meeting that some members were uneasy with abandoning historic preservation features that had been promised to the public since the building project’s earliest designs.

“That’s a really poor solution for an incredibly beautiful building and I’m just really disappointed to hear that.” – Town Councilor Pam Rooney

Rooney asked about an option previously identified by FAA of cutting around millwork and doing selective asbestos plaster rebatement. “Did that idea just fizzle?” she asked.

FAA’s Ellen Anselone replied that after talking with estimators, FAA concluded that the difficulty of this approach would negate most of the cost savings.

“Did that help?” asked JLBC Chair Austin Sarat.

“No,” insisted Rooney. “That’s a really poor solution for an incredibly beautiful building and I’m just really disappointed to hear that.”

JLBC member Alex Lefebvre asked exactly which interior woodwork elements were being removed.

Anselone explained that fireplace mantels and the main stair would be retained but everything else would go, “unless the group decides to tell us something different.”

“We’re just trying to help close the gap so if there’s a a reverse of direction, just let us know,” she said. “But we need to know right away,” she added.

Bockelman commented that he would like to see historic wood trim such as mantels and doorways saved, but he is reluctantly willing to sacrifice other millwork to achieve a simplification of the design.

Anselone responded, “If people want to save the door frames let us know, but the more bits you add in, you’re ticking up the complication.”

Sarat questioned Bockelman’s comment saying, “The committee did a pretty careful, I think deliberate kind of walk-through of all of these changes. […] Are you suggesting that we now reconsider some of that?”

“I said doorframes, what I meant was a stairwell,” Bockelman backtracked. “I realize I misspoke.”

“I actually thought I heard Paul say something a little different,” countered Rooney as she continued to argue against removing original millwork, especially on the first floor where the historic character of the building is most evident.

“I can’t imagine what those walls and those entryways would look like with Home Depot pre-primed baseboard,” Rooney remarked. “That just does not cut it for me.”

“It’s not Home Depot pre-primed, but again, we’re doing what we were told to,” said Anselone.

Capital Campaign Reports Little Progress in June

The Jones Library Board of Trustees meeting on June 8 included a report by Development Committee Chair Lee Edwards.

“The Capital Campaign is pretty much where we were last month,” acknowledged Edwards. “The Capital Campaign Committee is touring the building this week to try to get a handle on exactly what potential value engineered changes will be made in the building so that we can explain it to our current and potential donors.”

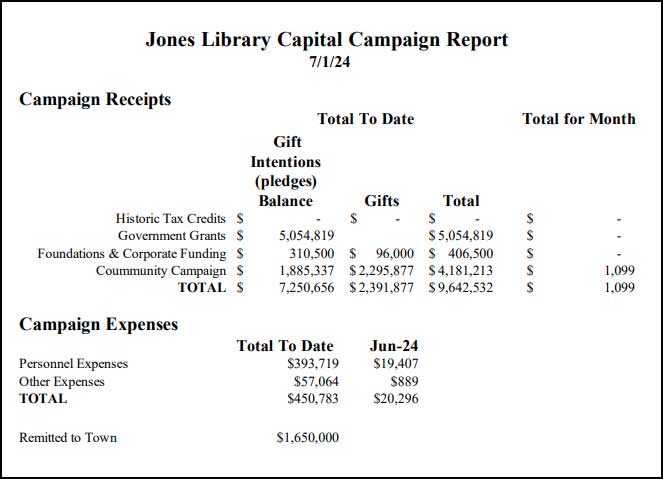

With a fundraising goal of $13,822,518 in order to meet the Library financial obligation under a Memorandum of Agreement with the town, and only $1,650,000 remitted to the Town Treasurer to date, the July 1 report contained alarming news.

A total of $1099 in gifts and pledges was raised in June. This was offset by $19,407 paid in fundraising personnel expenses.

The Town of Amherst and its taxpayers will ultimately be responsible for the $46,139,800 appropriated by the Town Council for the renovation-expansion project, should the revenue sources promised by the Jones Library Trustees fail to come through.

Wow! “total of $1099 in gifts and pledges was raised in June. This was offset by $19,407 paid in fundraising personnel expenses.”

Is the goal here to build for the community, or to line the pockets of people feeding at the community’s expense?

Imagine the Jones Library as a fragile patient seeking cosmetic reconstructive surgery, and imagine the folks involved as doctors arguing around the bedside about how to carry out these procedures.

Given the tone and content of their exchanges, who would offer these doctors affordable malpractice insurance?