Town Councilors Ask About Annual Budget Surplus

Photo: istock

Report on the Meeting of the Amherst Town Council, November 4, 2024, Part 2

This meeting was held in a hybrid format and was recorded.

Present

Lynn Griesemer (President, District 2), Mandi Jo Hanneke, Andy Steinberg, Ellisha Walker (at large), Freke Ette and Cathy Schoen (District 1), Pat DeAngelis (District 2), George Ryan and Hala Lord and George Ryan (District 3), Pam Rooney and Jennifer Taub (District 4), and Ana Devlin Gauthier and Bob Hegner (District 5).

Staff: Paul Bockelman (Town Manager) and Athena O’Keeffe (Clerk of the Council).

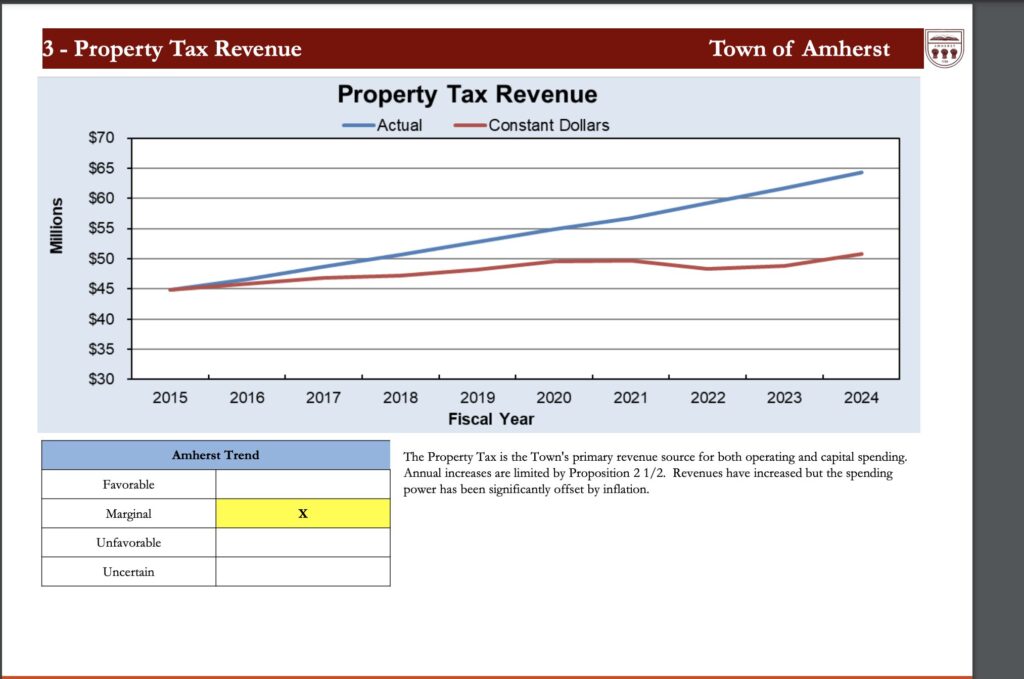

Financial Indicators Presentation Projects 3% Budget increase for FY2026

The regular Town Council meeting was preceded by a special meeting of the Town Council, Jones Library Trustees, School Committees, and Finance Committee to begin discussion of the FY2026 budget. Town Manager Paul Bockelman, Finance Director Melissa Zawadzki, Comptroller Holly Drake, and Treasurer Jennifer LaFountain presented the financial indicators for next year’s budget in the context of the previous 10 years. Inflation continues to be a major stressor for the town, outpacing revenue. Property taxes comprise 69% of total revenue, up from 65% in 2015, and is constrained by Proposition 2 ½, which limits the amount property tax can be increased each year to 2.5 %, which is often less than the inflation rate.

The percentage of revenue from state aid has decreased over the past 10 years from 20.4% to 18.6%. The number of employees has increased by 17.5 full-time equivalents since 2015. Wages and salaries make up 50% of the budget, with the costs of benefits rising from 38% to 42% of salaries. The town’s debt service is extremely low at 0.8% of revenues, but that amount is anticipated to rise in the near future, with construction of the elementary school and library. Reserves stand at $28 million, after the transfer of $5 million to the elementary school building project to lessen the impact of the debt exclusion override on taxpayers. The town continues to add 10.5% of its annual revenue to the capital stabilization fund, to pay for the four major building projects, which, it is hoped, will include a new fire station built without needing to ask citizens for another debt exclusion override by funding the fire station from the capital stabilization funds.

The presentation concluded that the town is in solid financial shape, maintaining its AA+ bond rating. The Finance Department estimates that each of the four departments (town, elementary schools, regional schools, and Jones Library) will be able to increase their budgets by 3% over FY2025. Amherst School Committee member Jennifer Shiao asked why the departments were only allowed a 3% increase in their budgets, when the town’s income went up by 4.6%. In fact, she noted, the regional schools were getting the equivalent of a 1 % increase, because the extra $355,000 given to them in June to avoid draconian layoffs was not added to the base operating budget amount. Zawadski explained that 10.5% of revenue was added to “Cash Capital” to reduce the borrowing needed for capital expenditures. That means there is less money for the operating budgets.

There will be a public forum on the budget on November 18, at 6:30 pm. Information on the budget is posted on the town website. An updated model on the timing and funding of the four major capital projects will be presented at that meeting.

FY2024 Budget Surplus of $5 Million

Zawadski reported that after required contributions of $74,000 to the Reparations Stabilization fund, $3.9 million to the Capital Stabilization fund, and $1 million to road and sidewalk repair6 for FY26, the FY24 budget had a remaining free cash balance of $5 million to be transferred to the general fund. Funding for a study of a new waste hauler system and a new sidewalk snowplow were also recommended to be funded with the free cash. The Finance Committee will discuss these proposed allocations on November 8 and will make a recommendation to the council on November 18.

Councilor Mandi Jo Hanneke (at large) noted that in most recent years, the town had a surplus of about $5 million. She asked if the town’s approach to budgeting was perhaps too conservative, and that it might be prudent to put more into maintaining core services. “How do we get closer [to actual expenses], so that we can actually use that money within the operating budgets and capital budgets of the year, not when we come here in November and reallocate them out?” she said.

Bockelman thought that a surplus of 5% of a $100 million budget was not unreasonable, but that the council can specify in its financial guidelines that a lower amount be projected for reserves at the end of the year. He stressed that maintaining the 10.5% contribution to the capital fund was important for maintaining current facilities and planning for the four major capital projects.

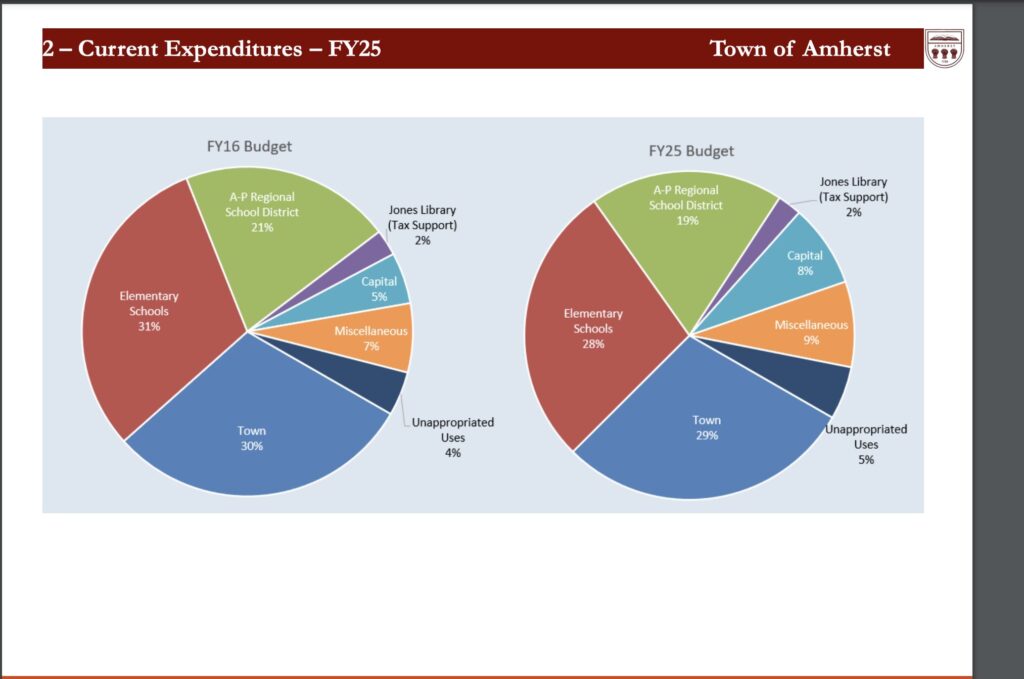

Hanneke’s suggestion to have less surplus and more in the operating budgets was enthusiastically endorsed by school committee (SC) members. Amherst SC Chair Sarah Marshall said, “It’s upsetting to see [budget surpluses of $5 million every year], because that’s money that is not at work in our town or our schools. Money is swept into free cash and is again out of reach of the schools, so I hope the Finance Committee and council do consider changing policy around the degree of conservatism in the budget.” SC member Irv Rhodes agreed, and thanked Hanneke for bringing the subject forward. He noticed that the elementary and regional school share of the town budget has declined by 3% and 2% respectively. See pie chart below.

SC member Deb Leonard stated that no town budget in the past five years has predicted a surplus, yet every year there is a substantial one. “I also question the overall value in telling the regional schools that there’s just absolutely no money in the budget for a $355,000 increase, but here you consider a reasonable overage at the end of the year to be 15 times that much, “ she said, adding, “The region can’t benefit from free cash at the end of the year. There’s no provision for that. And while I appreciate the issue of the bond rating, nobody ever wrote a letter to their Town Councilor, saying ‘Thank you for the bond rating.’ I would encourage you to think long and hard about the statements that are made about how Amherst values schools, and yet again and again we’re asked to cut our budgets, and seeing these kinds of overages is really, really difficult.”

Bridget Hynes, Shutesbury SC representative Anna Heard and Regional SC Chair Sarabess Kenney expressed similar sentiments. Hynes stated that the schools were cutting staff every year, while the town had added staff. Heard felt the needs of the regional schools presented at the Four Towns Meeting in September were not being listened to.

Zawadski said that most of the budget surplus came from the town operating budget, due to vacant positions that are now filled. However, there was $56,000 from the elementary schools that was added to the general fund.

Finance Committee members Cathy Schoen (District 1) and Bob Hegner were willing to consider making the operating budgets more generous and striving for lower surpluses, but Hegner stated that the town needed to be cautious about creating new positions, which would have to be funded in the future when the funds might not be available. Comptroller Holly Drake said that much of the surplus this year was due to excellent return on investments, which cannot be counted on every year. Bockelman emphasized that the town cannot spend more money than it has.

Amherst Again Adopts a Single Tax Classification for Residential and Commercial Property

Assessor Kim Mew stated that 88% of Amherst properties are classed as residential. This includes single-family homes to large apartment complexes. Commercial property comprises only 6.1%, and there is almost no industrial property. Personal property (items contained within a home) is 5.1%. Mew recommended that all property be taxed at the same rate, and the council agreed with a unanimous vote.

A split tax rate would shift some of the burden from residential property to businesses, but the Department of Revenue does not recommend adopting it unless commercial property is at least 25% of the total. A residential exemption would tax non-owner-occupied properties at a higher rate than those that are owner-occupied. However, this method would most likely penalize low income renters because the higher taxes would likely be passed on to them. The higher tax rate would also apply to properties occupied by family members who are not on the deed, such as a house purchased by a parent for a child. Mew said that 67% of residential property in Amherst is owner-occupied and 33% is rented. She said the residential exemption was developed for the Cape, where many homes are rented part of the year.

House Relocation Causes Widespread Power Loss and Road Closures

On Tuesday, October 29, the Roberts Group moved a historic house from 162 South East Street to 130 Harkness Road. The three-mile trip, mostly along Belchertown Road (Route 9) was slated to begin at 8 p.m. and finish by 7 a.m. the next morning. Residents were warned that they would lose electricity, phone, cable and internet during the move. However, according to Town Councilor Ellisha Walker (at large), who lives in the area, the move extended through most of Wednesday, October 30 and caused the Fort River School to be without power that day and resulted in traffic tie-ups in the area. Walker said the school buses could not make it to her house, so her children missed school and she missed work that day. She asked if house moves could be scheduled on a weekend or holiday to minimize disruption.

Bockelman said he is directing complaints from those who lost power and food during the move to Eversource. He said the town must accommodate house moves, but he didn’t know if it could specify the timing of such moves.

.