Tax Returns Offer Small Window onto Friends of the Jones Library Operations

Photo: https://www.joneslibrary.org/

Paid Fundraisers Not Identified

A recent post describing lack of transparency by the Jones Library’s private fundraising organization, The Friends of the Jones Library System, Inc. prompted Amherst Indy reader Michael Pill to point out that a 501(c)(3) entity must file an annual Form 990 tax return with the IRS, and that these returns are made available to the public by outlets such as ProPublica.

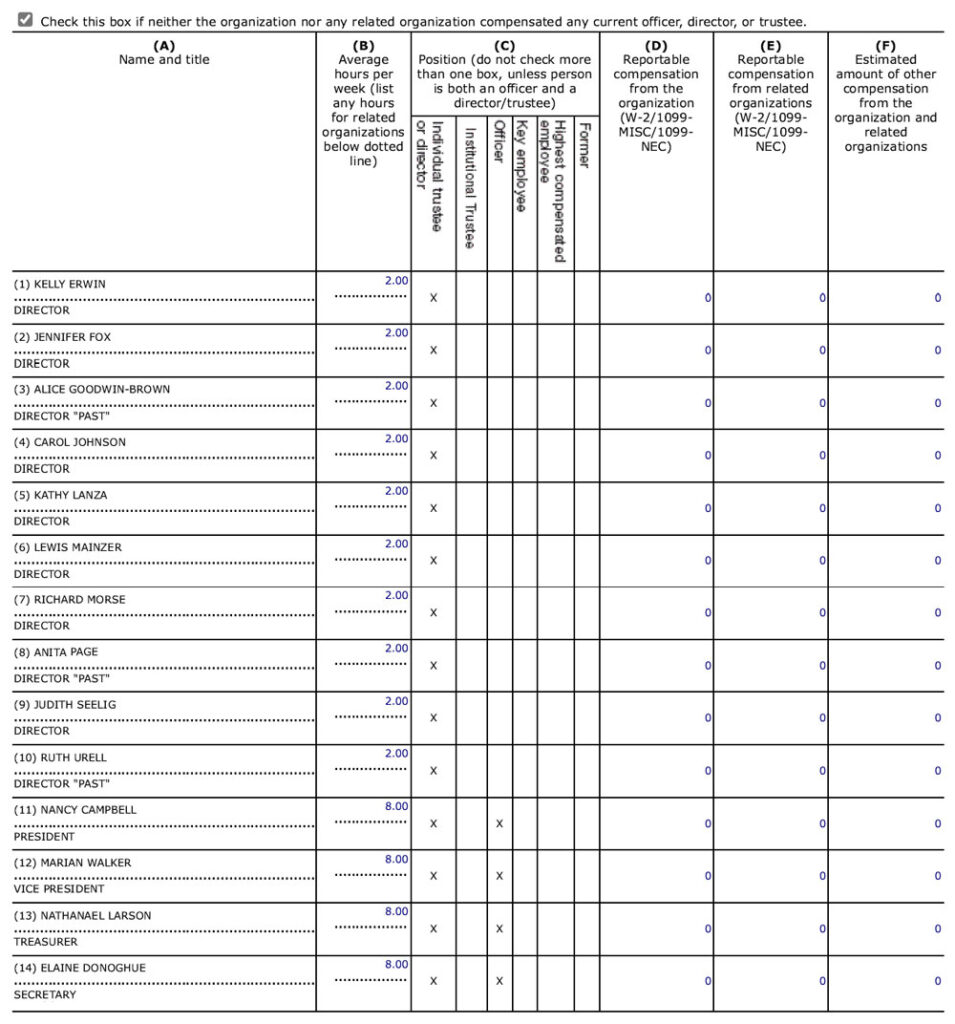

An examination of the Friends’ 2023 return, which covers the year ending on July 1, 2023, reveals a number Friends volunteers who receive no compensation for their fundraising and advocacy on behalf of the library. Fourteen individual trustees and directors are reported as working between two and eight hours per week without being paid.

These volunteers are separate from the professional fundraisers and paid staff who are known to receive compensation from the Friends’ Capital Campaign. For instance, Amherst Forward co-founder Ginny Hamilton has acknowledged being paid an undisclosed salary for her work as Capital Campaign Manager. Hamilton is not identified on the 2023 Form 990.

And in its monthly accounting, the Capital Campaign has reported paying out $188,557 in “personnel expenses” through July 1, 2023 without indicating on the tax return to whom these expenses were paid. Over the past nine months the Campaign’s total personnel expenses have grown to $327,412.

In an attempt to learn how Capital Campaign personnel expenses are being distributed and to confirm that there has been no conflict of interest, the Amherst Indy filed a Public Record Request in October 2023 seeking a breakdown of personnel expenses. Amherst’s Records Access Officer Sue Audette responded that this information is not tracked by the town and so could not be provided.

See related Library Project Fundraisers To Pay Themselves $1 Million Through 2027

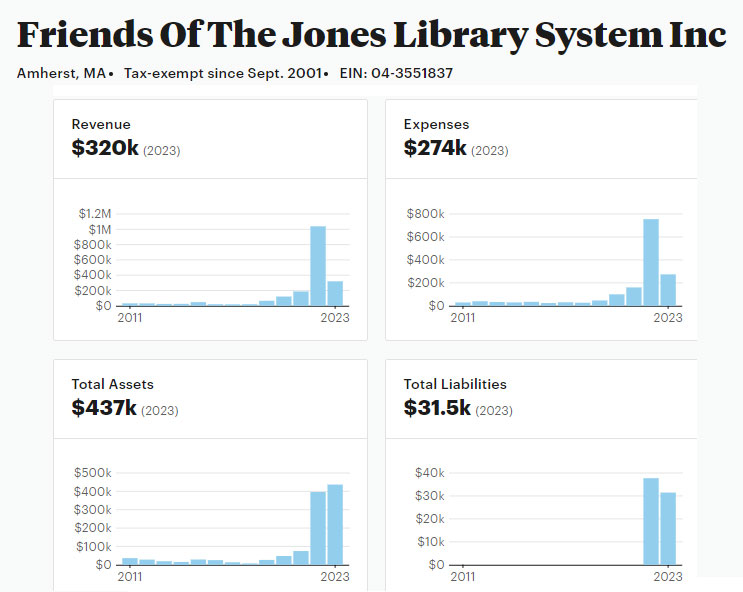

ProPublica’s Nonprofit Explorer includes historical data indicating the Friends’ fundraising success and amounts passed on in charitable grants. The tax returns do not identify who received disbursements from the Friends, but in some cases the recipients can be inferred from past announcements. In Fiscal Year 2023 the Friends took in total revenue of $320,221 while paying out $69,070 in grants, presumably to the Jones Library for operating expenses. The prior year, FY2022, was more active with revenue of $1,038,939 and grants totaling $641,357. The grant total appears to have included $500,000 remitted to the town toward the Library’s eventual total obligation of $13.8 million as its share of the $46.1 million renovation-expansion project.

Overall, revenue and expense figures reported on the Friends’ tax returns are at a high level so that details such as the source of contributions and who may be receiving fundraising commissions remain opaque to the public.

It should be noted that for the first 13 years of its existence the Friends of the Jones Library was a model philanthropic organization that was critical to the Jones Library’s reputation as a beloved public library and instrumental in keeping the financial commitment of the town toward library services to a minimum. It wasn’t until 2014, after promoting the idea of pursuing a multi-million dollar grant to support an ambitious renovation-expansion that the Capital Campaign became more overtly political as it sought to secure a commitment of $15.8 million in taxpayer funding from town officials.