Legality of $1M Jones Library CPAC Award Remains in Question

Photo: https://www.joneslibrary.org/

In June 2020 the Amherst Indy reported on a disagreement that had arisen on the Community Preservation Act Committee (CPAC) over recommending $1 million of CPAC funds “to assist in the construction of new quarters for the Special Collections Department of the Jones Library.” At issue was whether the proposed use of the award is allowed by Massachusetts Community Preservation Law (MGL 44B).

See related CPA Minority Report Urges Rejection of Jones Library Proposal

The nine-member CPAC administers funds that the Town of Amherst collects from a 3% surcharge on residents’ property taxes plus a matching amount from the state. The Community Preservation Act (CPA) permits funds to be spent on four purposes – open space protection, historic preservation, affordable housing, and outdoor recreation.

Three members of the committee, Planning Board representative Michael Birtwistle, former member of the Select Board Diana Stein, and CPAC Chair Nate Budington, protested that the library grant proposal did not adhere to the CPA requirement for the historical preservation category. They pointed out that eligible projects are limited to those that “acquire, preserve, rehabilitate or restore” historic resources. The library proposal to build a new Special Collections facility on the ground floor represents new construction which is not allowed.

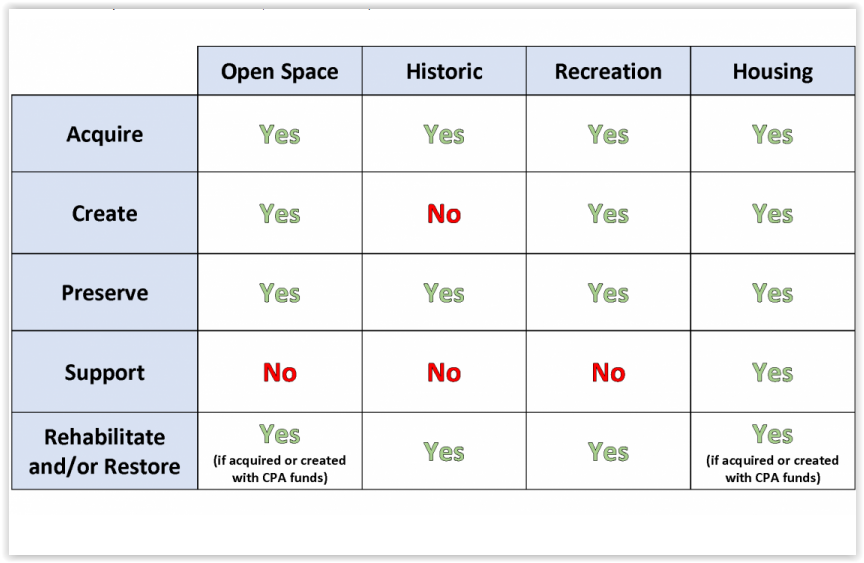

To confirm their understanding, they reached out to the Community Preservation Coalition (CPC), a statewide organization that advises local governments on community preservation initiatives. They received a letter from CPC Executive Director Stuart Saginor who referenced a chart prepared by the Massachusetts Department of Revenue (DOR).

“In looking at this chart, you are supposed to match what the CPA money will actually be spent on with the verb that describes that activity. In the case of building a new library, the CPA money is being spent to create the building, and that’s clearly not allowed,” he wrote.

CPAC member Stein also sought guidance from the Massachusetts Department Of Revenue (DOR), described as “the ultimate arbiter of any CPA issues.” Two individuals from the DOR contended that the library’s proposal “definitely does not qualify for CPA funds under the category of Historic Preservation.”

Offering an opposing opinion was Town attorney Shirin Everett of KPLaw.

“It is my understanding that the construction of the Special Collections Room is part of a larger construction project to renovate and/or expand the main Jones Library facility, which project is being funded by ·tax revenues, historic tax credits, private donations, and state grants. In my opinion, it is reasonable for the Community Preservation Committee (“CPAC”) to conclude that the use of CPA funds to construct a room that is specifically designed for and used to preserve and display the Town’s historic resources is permissible under the CPA,” he argued.

Ultimately a majority of the local committee chose to accept the advice of the Town’s lawyer over the state CPA consultants. They voted to recommend the $1 million award to the Town Council who approved it in April 2021.

Uneasy about the recommendation, Birtwistle, Stein and Budington submitted a minority report summarizing their concerns.

The $1 million CPAC award is a critical piece of the Capital Campaign’s funding formula for the proposed $46.1 million Jones Library renovation expansion project. More than four years later, its legality remains an open question.

What a curious mental operation KPLaw attorney Shirin Everett uses to arrive at her idiosyncratic conclusion,

“In my opinion, it is reasonable for the Community Preservation Committee (“CPAC”) to conclude that the use of CPA funds to construct a room that is specifically designed for and used to preserve and display the Town’s historic resources is permissible under the CPA.”

She cites in support “a larger construction project to renovate and/or expand the main Jones Library facility, which project is being funded by tax revenues, historic tax credits, private donations, and state grants.” So, Ms. Everett adduces as her historic preservation justification 1) the type of overall project (‘renovate and/or expand)”, and 2) the various sources of revenue for that overall project.

To “renovate” and to “expand” do not necessarily have anything to do with historic preservation. So we must look elsewhere for Ms. Everett’s “historic preservation” justification.

“Tax revenues” and “private donations” might be used for anything. They are both irrelevant to whether this CPA grant can fall within the CPA requirements for historic preservation.

“Historic tax credits”? As is now well known, the Massachusetts Historical Commission (MHC) has determined that this Jones Library demolition/expansion project (Project) fails to qualify for them. This is because of several evidently integral “adverse effects” that violate the applicable Secretary of the Interior’s Standards for the Treatment of Historic Properties. Consequently, “historic preservation tax credits” will never be part of the financing for this Project, if ever it is completed. They thus cannot be part of the thought process used to justify a CPA grant for historic preservation.

Finally, what about those “state grants”? Those are contingent on the Project’s compliance with the applicable Historic Preservation Law. For at least eight years, the Town of Amherst and Jones Library Trustees, evidently abetted by their architects and Owner’s Project Manager, have successfully foiled any determination by the MHC of whether their Project complies with the State law.

Because it has also received federal grants, however, and because the Jones Library is also on the National Register of Historic Places, the Project must now comply with the National Historic Preservation Act, as determined in a process under Section 106 of that Act.

But does it so comply? Evidently not. The MHC Executive Director has a key role, as State Historic Preservation Officer (SHPO), in any compliance process under Section 106. In a letter dated November 1, 2024 (https://www.amherstindy.org/wp-content/uploads/2024/11/SHPO-Response-Letter_HUD-Pt-58-Amherst-Jones-Library-Modifications_021449.pdf), the SHPO informed the Town of Amherst diplomatically that she

“looks forward to consulting with the Town of Amherst … to explore alternatives that would eliminate or minimize the adverse effect of the proposed project.”

The SHPO goes on to ask the Town of Amherst for alternatives to such “adverse effect,” notably including an alternative to “the size, scale, and massing of the proposed addition.”

Yet even if the architects redesign this Project to eliminate or minimize its “adverse effect,” and thus to pass Section 106 muster, the CPA grant will still be “to construct a room” that, whatever its initial designation, could ultimately be used for something else. For instance, just this past June, the Jones Library architects’ schematic design reassigned a 545 SF room from the Library’s Special Collections of historic materials to the display of the Town’s Civil War Tablets. (https://www.amherstindy.org/2022/06/24/library-grants-room-to-civil-war-tablets-volunteer-librarians-nixed/)

Sorry, Ms. Everett. I am not convinced.

“I don’t think we should take any CPA funds until 100% of Massachusetts communities are getting an equal distribution of CPA money that is generated by taxes that we pay to the state.” 57% of the communities are CPA communities, and this covers 71% of the state population. Although, argued by some, the non profits that back the CPA are worthy causes, they do not represent voters of all political stripes. This seems unfair considering that CPA funds come from 100% of Massachusetts taxpayers. The CPA was started in 2001 by Republican Governor Paul Cellucci, and some cynics (me) would argue that it empowers the status quo and the wealthier portion of our society because to become a CPA community, that community must be willing to donate and afford a CPA surcharge as part of property taxes, a regressive tax. CPA surcharges can go from 0.5 to 3%, and Amherst is part of the 3% group. A cynic might say that Paul Cellucci and the Community Preservation Coalition (it backs the CPA) on Beacon Street in Boston could not levy the surcharge on all communities in the state because they knew that not all communities would tolerate higher property taxes, once again, a regressive tax.

All this leaves some communities and some members of the Commonwealth out in the cold.